If you have been a long time reader (and followed me over at The Krazy Coupon Mama in the very early days of my blogging), you may remember my story and the financial struggles I was facing during that season of life.

You see, I started “The Krazy Coupon Mamas” back in June of 2011 at the height of all that “crazy couponing”. It was, at first, just a platform for a small group of local stay-at-home mamas in a playgroup. We clipped and swapped coupons at the trampoline center. We shared deal tips, sales, and bargains at the park playground. We taught each other how to coupon at in-home play dates. We had a place to vent when things at the register didn’t go like they did on TV. We had a wonderful group of like-minded “savers” to go to for encouragement and support to try it all again!

But soon that small group of mamas at the playground led to a bigger Facebook group, which in turn led to a Facebook page, and then, before I could even breathe, I was running a full-time blog. Oh my word what a challenge I had set up for myself. I was a stay-at-home parent with a little one (and apparently did not have enough on my plate already) and that little blog somehow took off and became my life! Krazy Coupon Mamas was a full-time, working like crazy, not earning me a nickel J.O.B.!

The couponing, and even the “deal” blogging, was a lot of fun at the outset. But what many did not know was that I was doing this to keep my family afloat. Like, seriously. I was not hoarding coupon inserts from the newspapers and “crazy couponing” and going nuts at the register at Walgreens and building a stockpile that rivaled a charitable food pantry and a drugstore for the adrenaline rush. No. I was doing it to keep food on the table to feed my family at that moment.

You see, I was laid off from my teaching job in 2008 (along with about 10,000 other California teachers) when my son was an infant. Yep. Got the pink slip over the Christmas break while I was on an extended and (unpaid) maternity leave and dealing with undiagnosed PPD – but that’s another story. I went back to work in January and finished out the year in June. My husband started working for the state during this time, so we were surviving on his brand new income and my unemployment benefits.

So, we had a newborn, two cars, and we had just purchased a house that needed a ton of work. We were not even looking at the luxuries of life anymore. We knew we had pretty substantial credit card debt to go along with our mortgage and other monthly bills, and we needed to find ways to keep on top of it all while we rode the recession out.

I took on some part-time babysitting for a former colleague, which helped us pay down some of the credit card debt rather quickly. (I used to joke with my friend that we nick-named the baby Visa – as in Visa payment! $50 a day went a long way in paying down our debt!) We tapped into our small savings accounts. We used some of the money I inherited from my mother’s estate (money that should have been saved for our retirement or some other extreme financial situation). I cut back on shopping and unnecessary spending. It soon became a game of strategy to keep what my husband was earning in our bank accounts for as long as possible. And it was working. Until the bottom fell out…..again.

As a temporary employee, my husband’s position with the state was cut. And then my unemployment benefits ran out. We were now going to go from “barely making it” to a “Jesus take the wheel, please!“ kind of survival mode. How in the world were we going to manage this? How were we going to ever see the light at the end of the tunnel when our tunnel was just obliterated by a landslide? The quiet tears. The constant worry. The fears. The anxiety. The feelings of hopelessness. The depression. The discouragement. The embarrassment. And the prayers. We went through it all.

We knew digging out and staying near the top would be tough, but there was no other way than to just borrow a couple of shovels and start chipping away at the mess, scoop by scoop, wheelbarrow by wheelbarrow, and sometimes what felt like grain of sand by grain of sand.

This season of our lives was extremely difficult as the unemployment benefits did little more than pay our mortgage and some other small monthly bills. I struggled to maintain a household budget of, well, there really wasn’t a budget! The money that was pinched went to food and other necessities. I felt like my job was to make sure those already pinched off pennies were stretched even further!

There were literally hundreds of things that we did to cut corners and make those ends meet, but here are a few of the real game changers that saved us.

I clipped coupons. For everything. If it could be purchased with money, we had to have a coupon to go with it or we didn’t buy it. Through my efforts in couponing I was able to keep the fridge and pantry stocked with everything from dental floss to mustard. No, not 453 bottles worth, but we had plenty and all varieties too!

I discovered how to monetize my blog and start a steady trickle of income for all of my crazy efforts.

We never ate out. Like ever. Unless there was a family dinner or a super special occasion, we ate from the pantry.

We cancelled the cable. Completely. At that time we had no idea about cheaper alternatives or streaming or whatever. We just knew that $130 per month for a TV subscription that we were not even using (except for kid shows OnDemand) was insane and it had to stop. (And flash forward to today, we still don’t have any kind of TV service!)

We did all of our own home repairs and maintenance. And any time we had a little bit of extra money, we invested in improving our home so it could be sold quickly when the market turned around.

We reduced our home energy costs. Tremendously. This was by far the greatest way we found to chip away at our household expenses.

I never shopped for anything that was not a life necessity. If we were not hurting for it, I didn’t buy it. We Reduced, Reused, and Recycled anything we could get use out of!

And if we were hurting for something, I shopped yard sales, and thrift stores, and estate sales, and consignment sales.

I learned how to sell things on Facebook and Craigslist.

I continued to babysit part-time for my friend.

And, after 14 long and miserable months, my husband was eventually rehired through temporary contracts and then finally in a permanent capacity. Over the last several years, we have been able to start replenishing our savings and breathing a bit more freely financially.

Becoming this new Super Frugal Woman was both challenging and encouraging. It gave me such a sense of fulfillment and purpose. I was able to help my family even if I was not gainfully employed. It gave me a chance to see that I was capable of finding an “out” when we were in the bottom of the ninth. It gave me hope that whatever financial circumstance popped up, we would be able to work together to see our way past it and rebuild again.

Now that our son is older, the discussion of when I would be returning to work has come up several times. But, after considering day care costs, my husband’s unpredictable work schedule in the fire/forestry industry, our belief in a home education, and the fact that we are living in a new area without the support of friends and family – living on one income will continue to be our normal and the “frugal entrepreneurship” continues!

Becoming an “entrepreneur” definitely does not look the same for everyone. Selling a MLM product, medical transcribing, crafting an Etsy shop, teaching piano lessons and things like that just did not fit who I am. But I also knew that going back to a job that required incredibly long hours, offered very low pay, increased my stress levels, kept me away from my family, and that I was no longer passionate about was also not where I wanted to be!

Finally realizing that my talents and passion lay in something as simple as sharing my life stories has been such an amazing discovery! Yes, my blog may not be the most popular. And yes, I may not be pulling in a 6-figure income doing it. And yes, my endeavors may change in the future as the needs of our family change. But for now…..

- I am able to earn extra income to help support our family (and I can say crazy cool things like “Honey! Do you realize I have not taken money from the ATM in over 2 years?!”).

- We are able to continue homeschooling without any out-of-pocket expense.

- We are able to live and give more generously with our time and our resources.

- We are able to fly home to visit family and friends in Hungary every year.

- We have been able to realize some pretty important dreams for our family’s future! (Which I am so excited to finally share with y’all in the next couple of weeks!)

- And I have a deeper more meaningful sense of purpose and fulfillment in my life (outside of my family and an employer), and that to me is absolutely priceless.

I have gone from “Just Barely Making It” to full-fledged “Money Making Mom”!

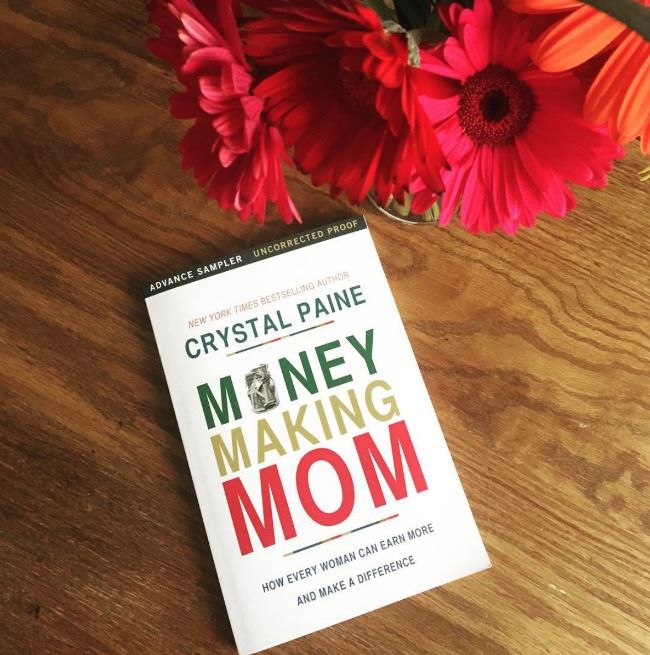

I have been reading through a pre-release copy of Money-Making Mom: How Every Woman Can Earn More and Make a Difference and I have to say that this is the exact book I wish I had as a resource and an encouragement when we were really struggling! Crystal is such an amazing cheerleader and champion because she’s been there too! I really loved the chapter on discovering (and learning the difference between) your passions, skills, talents, and knowledge and how you can apply these in brainstorming your next steps. I had to really sit and do some reflecting and reassessing to see what my true talents were and what areas my passions really were in.

The book will teach you how to:

✓ Expand your thinking to consider multiple money-making ideas

✓ Dream big and set long-term financial goals

✓ Forge an intentional path with clear priorities

✓ Nurture your unique skills, talents, passions, and knowledge

✓ Conquer the saboteurs of insecurity, fear, lack of time, and naysayers

✓ Shift your perspective to live more generously for others

✓ and much more!

You can save $5 on the purchase of this book on Amazon! Use promo code GIFTBOOK at checkout through December 12th, 2016 at 2:59 a.m. EST! (Coupon terms & conditions) And, the Kindle version is just $1.99 right now!

I just know this book will inspire and encourage you like it has for me. Are you struggling financially and constantly feeling like there is always “more month at the end of the money”? Maybe your budgeting and money-saving efforts are finally paying off and you’d like to start living and giving more generously in your community or across the world. Do you have a dream in life that you are ready to start pursuing? Or maybe you know somebody that is going through a financial shift that would be blessed and encouraged by this book. Please, please share this with them. ♥

Leave a Reply